Using a UK Mortgage Calculator for Remortgaging: What You Should Know

Getting a rentals are just about the most considerable monetary options some people make, in addition to ensuring you can afford a mortgage is necessary for you to the success of your investment. The most effective instruments open to homebuyers within the UK can be a mortgage calculator. This tool will help you greater be aware of the monetary motivation interested in your residence purchase. Here are a few crucial benefits of using some sort of Mortgage Calculator UK if arranging your next household purchase.

1. Quick and Genuine Economical Analysis

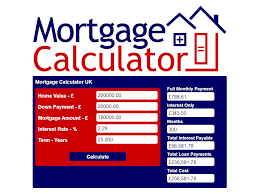

Your mortgage calculator allows you to enter numerous guidelines, including mortgage quantity, rates, and also mortgage time period, to have a quick and appropriate appraisal of your respective monthly payments. This protects some time and assures that you will be well-informed just before investing your mortgage agreement.

2. Assists Arranged some sort of Genuine Finances

Simply using a mortgage calculator , it is simple to determine what you might afford. The particular tool helps you examine the amount of you will need to use as well as precisely what your current repayments will be like. This kind of clearness enables you to fixed an authentic finances and prevent overstretching your current finances.

3. Comprehend the Result with Attention Charges

Rates perform an important role around the total cost of this mortgage. Mortgage calculators allow you to imagine the results of several interest rates on your monthly installments and whole repayment in excess of time. This lets you help to make smart options relating to fixed or even variable fees, assisting you get the best choice on your situation.

4. Evaluate Different Mortgage Solutions

Mortgage Calculator UK usually let you to test out a variety of personal loan phrases as well as settlement wavelengths, providing you the cabability to evaluate several options. No matter whether you prefer the shorter-term loan with regard to faster settlement or a long term to lower monthly costs, this calculator can help you select the best fit.

In conclusion, using a mortgage calculator is an essential step in getting some sort of mortgage for your forthcoming UK property purchase. It helps you are making informed options, program your capacity to pay, and also pick a qualified mortgage choice, inevitably environment people way up to get a very good plus on a financial basis ecological homeownership experience.